Step 1. Choose basis of presentation of reports

International Financial Reporting Standards

Management accounting

Differences

Management accounting information differs from financial accounting (namely, IFRS) information in several ways:

• while financial accounting information is computed by reference to general financial accounting standards (IFRS, US GAAP, etc), management accounting information is computed by reference to the needs of managers, often using management information systems;

• while shareholders, creditors, and public regulators use publicly reported financial accounting information, only managers within the organization use the normally confidential management accounting information;

• while financial accounting information is historical, management accounting information is primarily forward-looking.

Step 2. Choose financial reports you need

Main reports:

May be prepared for group of companies, for single organization, for separate devision/ department/ segment/ etc.

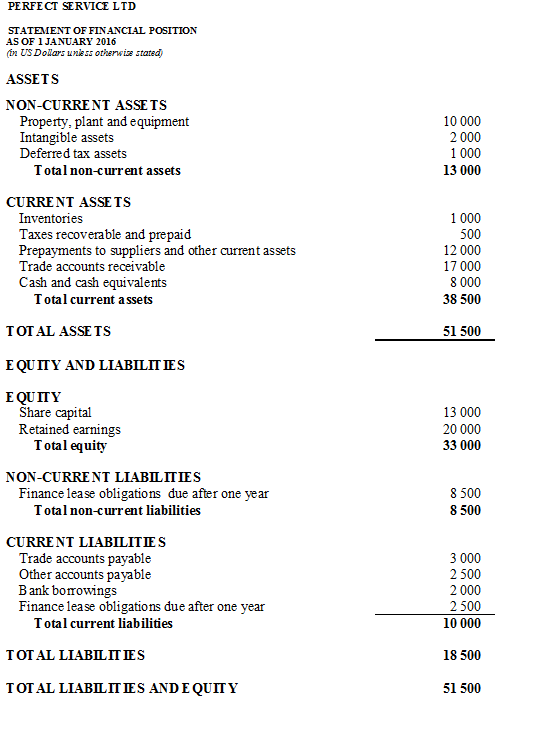

Balance Sheet

- Your assets: what you have.

- Your equity and liabilities: what are the sources of what you have,

namely:

- liabilities: what your debts, what you owe;

- equity: own capital.

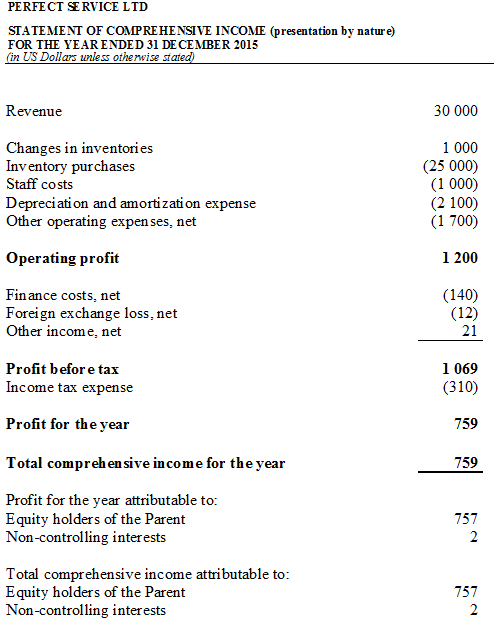

Profit & Loss Statement

- Your income and expense for the period.

- Your final result – profit or loss.

Two forms of presentation are possible:

- by nature;

- by function.

Other reports:

Management accounting. Examples of management accounting reports that may be prepared upon request:

Historical data reports and analysis:

fixed costs and variable costs analysis, sales analytics (sales by department, sales by product, sales trends, sales and sales returns analysis, etc), bad bebts report, ageing of accounts receivable, cost of sales by elements analysis, other.Calculations:

calculation of break-even point (BEP), cash call calculation, other.Forecasts:

cash flow forecast, fixed and variable costs forecasts, budgets and other forecasts.

IFRS. Full set of financial statements in accordance with IFRS comprises:

1) a statement of financial position,

2) a statement of profit or loss and other comprehensive income,

3) a statement of changes in equity,

4) a statement of cash flows and

5) respective notes to abovementioned statements.

View other examples:

Step 3. Choose your package

| No of transactions (for single company) |

up to 50 | up to 100 | up to 200 | up to 500 | up to 1000 |

|---|---|---|---|---|---|

| PL report | $20 | $40 | $80 | $200 | $400 |

| PL+BS reports | $30 | $60 | $120 | $300 | $600 |

| Timing, working days | 2 | 3 | 4 | 5 | 5 |

Get your discount!

| Order | Discount, % |

|---|---|

| 3 months order | 10% |

| 6 months order | 30% |

Get individual offer!

Please, contact us for individual price proposal in case when:

- you have more than 1000 transactions;

- you require specific management reports;

- you need daily or weekly reports.

Step 4. Start the process

| 1. Submit your request. | 2. Receive NDA. Get your invoice. | 3. Make a prepayment. | 4. Submit your bank statement and other data (if applicable). | 5. Answer some questions. | 6. Receive your reports. | 7. Ask your questions. | 8. Process final payment. |

|---|